How Equi Hedge Works

-

Equi’s hedging program was launched in February of this year to mitigate the impact of market drawdowns and protect the portfolio from short-term market risks.

-

The hedging program is a balancing act between reducing risk and maximizing the returns of the portfolio.

-

Equi tackles this balancing act with a focus on two primary factors: correlation and convexity.

-

Equi’s hedging program was launched in February of this year to mitigate the impact of market drawdowns and protect the portfolio from short-term market risks.

-

The hedging program is a balancing act between reducing risk and maximizing the returns of the portfolio.

-

Equi tackles this balancing act with a focus on two primary factors: correlation and convexity.

A core component of Equi’s investment mandate is to outperform a public market allocation (ex. S&P 500) over the long run by mitigating impact from market drawdowns, and retaining upside convexity. In order to achieve this aim and protect the portfolio from short-term risks that we may have exposure to through our underlying managers, Equi launched our internal portfolio hedging strategy in February. The goal of this strategy is to protect the portfolio from short-term drawdowns while allowing us to remain fully invested in order to participate in market recoveries. This strategy has performed as intended YTD, up 40% through the end of October, protecting against the handful of managers that have struggled this year, while also allowing us to remain invested in the strategies we believe have embedded upside going forward.

The hedging program is intended to be a delicate balancing act between both reducing risk and maximizing return on the current portfolio of managers, and offsetting any global system risk. The appropriateness of having either higher degrees of protection in our portfolio vs. smaller amounts geared at protecting against potential unforeseen market events is assessed at all times. Equi thinks about this problem in two parts.

Correlation

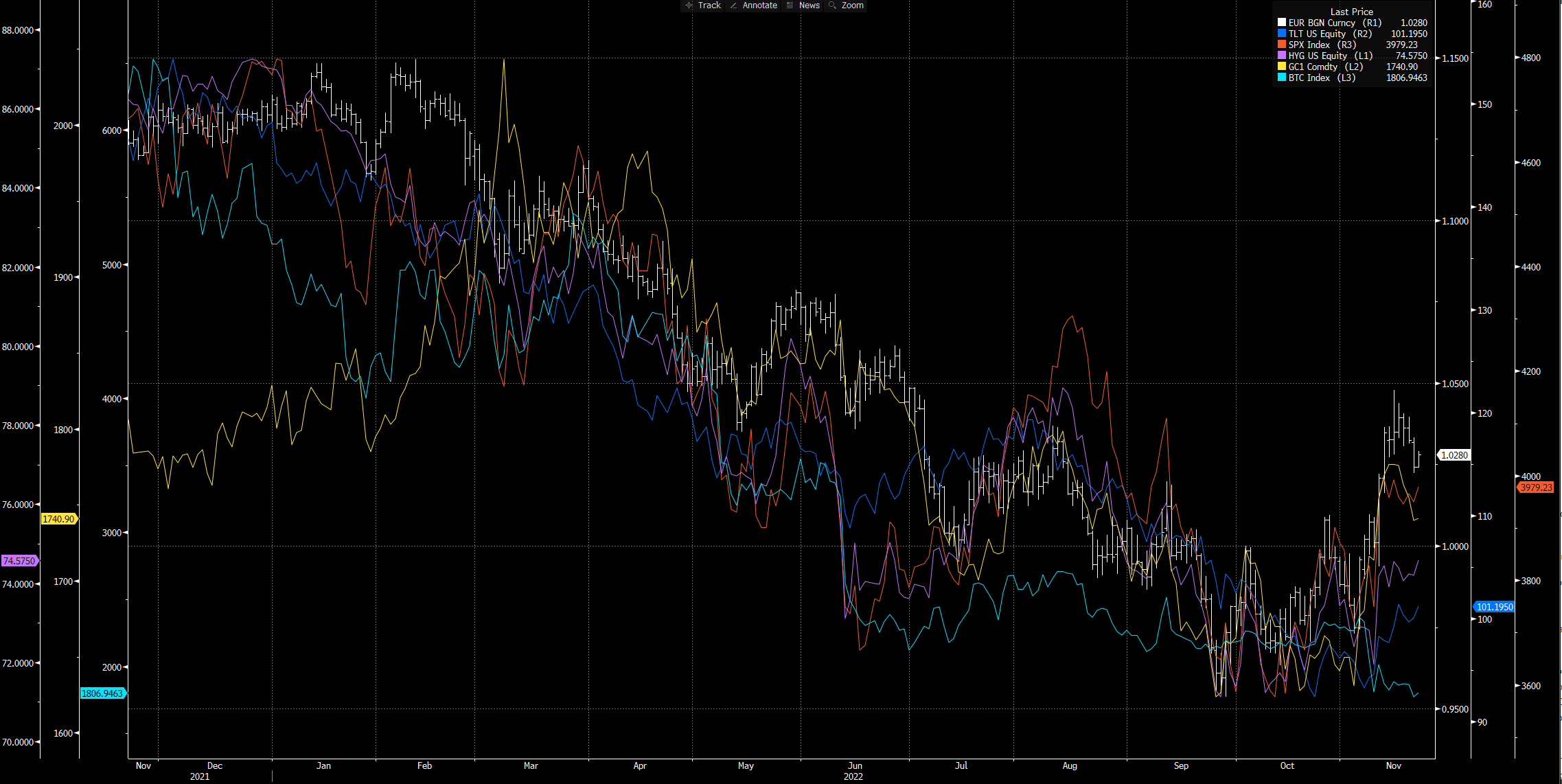

Historically, the correlation across asset classes tends to pick up and approach 1 during periods of market turmoil (such as what we’ve seen in 2022). We track the correlation between our underlying managers as well as across global asset classes (bonds, commodities, USD, and many others). Generally speaking, we will continue to hedge while the correlation is high and reduce the hedges when we see a decorrelation. This is because when the correlation is high, there is minimal benefit to diversification, due to the fact that as different asset classes decline in tandem they essentially move as if they were just one single trade. We can therefore reduce hedges once diversification “works” again when the correlation drops. The following chart illustrates this phenomenon in action this year, with various asset classes exhibiting similar behavior (albeit with varying degrees of volatility).

(chart source Bloomberg: EUR/USD, US Treasuries, S&P 500 index, High Yield Bonds, Gold, Bitcoin)

Convexity

We use financial instruments with embedded leverage such as options and futures in order to hedge. This allows us to risk smaller amounts of capital to hedge vs. fully negating/canceling manager returns. For example, we could purchase a volatility option to offset risk from our volatility manager. This may cost a lump sum equal to a hypothetical 10% of the expected annual returns of a given manager. In the event volatility spikes, the option could increase 10x and fully negate any negative losses for the manager. In the event volatility declines, we would have therefore reduced the returns of the manager by only 10% from the expected annual returns. This is the notion of using convexity to hedge.

Although this is an oversimplified explanation of the intricacies of our hedging program, it sufficiently illustrates the core principles that guide how we think about protecting our portfolio.